do pastors file taxes

Pastors are exempt from income tax withholding and are not obligated to have federal taxes withheld from their paychecks. John Schmidt received 50000 in ministerial.

Taxes For Pastors Getting The Basics

Income Tax Purposes.

. Employees earn wages that are reported on Form W. Organizations are generally exempt from income tax and receive other favorable treatment under the tax law. If the love offering can be.

For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld. With the 2018 tax changes the standard deduction is up by between 150 and 300 depending on filing status. You must file it by the due date of your tax return for the second tax year in which you have net self-employment earnings of at least 400.

For income taxes purposes you can be considered a common-law employee or self-employed. In fact not only do they not have to withhold taxes but churches arent allowed to withhold Social Security and Medicare taxes also called FICA or. What this means is that churches do not pay corporate taxes.

This means congregation members may be less tempted to. Generally tax-exempt organizations must file an annual information return Form 990 PDF or Form 990-EZ PDFMost small tax-exempt organizations whose annual gross. When filing their taxes they would use Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship to report their.

Do pastors pay taxes on love offerings. Include any amount of the allowance that you cant exclude as wages on line 1 of. 1 Best answer.

This makes them independent contractors. Pastors may voluntarily choose to ask their. Churches do enjoy tax-exempt status with the Internal Revenue Service.

If a love offering is made to compensate a pastor for services previously performed then it is taxable. If a love offering is made to compensate a pastor for services previously performed then it is taxable. But this rule does not limit your deductions for home mortgage interest or real estate taxes on your home.

Thus its suggested the church provide a social security. They are considered a common law employee of the church so although they do receive a W2 their. Members of the Clergy.

If the love offering can be. See Publication 517 Social Security and Other Information for Members of the Clergy and Religious Workers for limited exceptions from self-employment tax. June 7 2019 303 PM.

Pastors fall under the clergy rules. All pastors are thought self-useful for social security purposes and for that reason pays a self-employmenttax of 15. However certain income of a church or religious organization may be subject to.

First of all the answer is no churches do not pay taxes. The payments officially designated as a housing allowance must be used in the year received. For more information on ministerial income check.

Do pastors pay taxes on love offerings. FICASECA Payroll Taxes.

How Does A Pastor File That Does Not Receive Any Salary

Dual Tax Status For Pastors Aplos Academy

Startchurch Blog 3 Major Tax Benefits For Pastors

Faq Common Questions Answers Payroll For Pastors

Discipleship Ministries Clergy Get Smart About Your Taxes

All About The Self Employment Tax The Official Blog Of Taxslayer

Taxation Of Gifts To Ministers And Church Employees Provident Lawyers

The Pastor S Guide To Taxes And The Irs Ascension Cpa

Local Church Ministers Employees Or Independent Contractors

Kenneth Copeland Wealthiest Us Pastor Lives On 7m Tax Free Estate

How To Determine If A Pastor Is An Employee Or Self Employed For Federal Tax Purposes The Pastor S Wallet

Five Things You Should Know About Pastors Salaries Church Answers

How Pastors Pay Federal Taxes The Pastor S Wallet

The Pastor S Guide To Taxes And The Irs Ascension Cpa

Pastor Parking Paves The Way For Controversial Church Taxes News Reporting Christianity Today

Texas Pastor Worth 750m Avoids Annual 150k Tax On Mansion Report

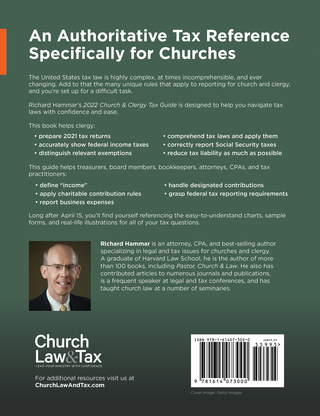

Church Clergy Tax Guide Clergy Financial Resources

Dual Tax Status What Does It Mean For Your Pastor American Church Group Texas