vermont state tax rate 2021

2022 Interest Rate Memo. The windham county sales tax rate is.

Vermont Estate Tax Everything You Need To Know Smartasset

2015 Income Tax Withholding Instructions Tables and Charts.

. Tax rates for fiscal 2021 were determined using schedule 1 which generally has lower rates than schedule 3. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax. 2015 VT and Tax Tables.

Vermont announces an increase in state unemployment insurance tax rates effective July 1 2021. Tax Rates and Charts. Matt Cota of the Vermont Fuel Dealers Association recently sent out its weekly bulletin to its hundred-plus members the people who bring fuel oil and propane to.

Taxvermontgov Page 42 2021 Vermont Tax Rate Schedules. Tax rate used in calculating Vermont state tax for year 2021. IN-111 IN-112 IN-113 IN-116 HS-122 RCC-146 HI-144.

She leverages this background as a fact checker for The Balance to ensure that facts cited in articles are accurate and appropriately sourced. Exact tax amount may vary for different items. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US.

2022 Vermont state sales tax. 2021 Vermont Tax Tables. Meanwhile total state and local sales taxes range from 6 to 7.

The Amount of Vermont Tax Withholding Should Be. Vermont sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. If a state income tax certificate has not been processed or if a valid state exemption code is not present the Federal exemptions will be used in the computation of state tax.

Tax Rates and Charts Wed 08182021 - 1200. Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax brackets. Base Tax is 2727.

This law raised income taxes by reducing the kick-in for the states top marginal individual income tax rate. 2021 Vermont Income Tax Return Booklet. Find your Vermont combined state and local tax rate.

2016 VT Rate Schedules and Tax Tables. Location is everything if you want to save a few income tax dollars. Tax Rates and Charts Tuesday December 21 2021 - 1200.

2022 Income Tax Withholding Instructions Tables and Charts. 5 rows 2021 Vermont State Sales Tax Rates The list below details the localities in Vermont with. 6 In New Jersey A10 was enacted in September 2020 expanding the states so-called millionaires tax.

State unemployment taxes are paid to this Department and deposited into a trust fund that can only be used for the payment of benefitsThe state tax is payable on the first 15500 in wages paid to each employee during a calendar year. There are a total of eleven states with higher marginal corporate income tax rates then Vermont. 4 rows Vermont state income tax rate table for the 2020 - 2021 filing season has four income.

The vermont state tax tables for 2022 displayed on this page are provided in. 2016 Income Tax Withholding Instructions Tables and Charts. Multiply the result 7000 by 66.

Personal Income Tax Woes Plague State Revenues Again Vermont Business Magazine Paying Social Security Taxes On Earnings After. Add this amount 462 to Base Tax 2727 for Vermont Tax of 3189. Overall state tax rates range from 0 to more than 13 as of 2021.

For tax year 2021 Michigans personal exemption has increased to 4900 up from 4750 in 2020. The vermont sales tax rate is currently. Unlike the federal estate tax system Vermont does not permit the portability of credits.

Filing Status is Married Filing Jointly. Learn about our editorial policies. Subtract 75000 from 82000.

On or after January 1 2021 the exemption rises to 50 million. Additional withholdings will be held at 27 percent of the Federal tax withheld and added to the state tax. The Marital Deduction - QTIPs.

An Official Vermont Government Website. Employers pay two types of unemployment taxes. With proper planning a married couple will be able to shelter 10 million from Vermont estate tax starting in 2021.

3 hours agoVermonts largest city has until May 9 2022 to respond to the Internal Revenue Services request to substantiate its use of project proceeds in relation to a. Before sharing sensitive information make sure youre on a state government site. 5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as.

A financial advisor in Vermontcan help you understand how taxes fit into your overall financial goals. Vermont has four state income tax brackets for the 2021 tax year. State and Federal Unemployment Taxes.

The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. 2017-2018 Income Tax Withholding Instructions Tables and Charts. State government websites often end in gov or mil.

The base state sales tax rate in Vermont is 6. VT Taxable Income is 82000 Form IN-111 Line 7. This booklet includes forms and instructions for.

FY2022 Education Property Tax Rates. 2021 Income Tax Return Booklet. The Median Vermont property tax is 344400 with exact property tax rates varying by location and county.

FY2022 Education Property Tax Rates as. Un-elected officials would set heating fuel tax rate. Local tax rates in Vermont range from 0 to 1 making the sales tax range in Vermont 6 to 7.

The Vermont Department of Labor announced that its fiscal year 2022 July 1 2021 June 30 2022 state unemployment insurance SUI tax rates are determined on Rate Schedule III with rates ranging from 08 to 65 up from fiscal year 2021 where Rate Schedule I.

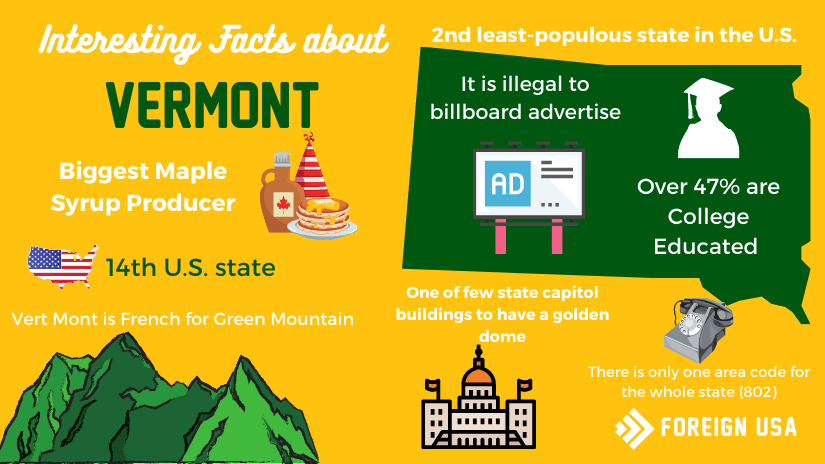

Discover 14 Of The Most Fun And Interesting Facts On Vermont Economic Ones Too

Which States Have The Lowest Property Taxes Property Tax Usa Facts American History Timeline

Filing A Vermont Income Tax Return Things To Know Credit Karma

Vermont Nickname Learn What The Vermont State Nickname Is

Vermont Income Tax Calculator Smartasset

Vermont Income Tax Brackets 2020

Vermont Income Tax Calculator Smartasset

Merger Activity Agency Of Education

Vermont Is Paying People To Move And Work There

Personal Income Tax Department Of Taxes

Vermont State Tax Information Support

Vermont Retirement Tax Friendliness Smartasset

Vermont Income Tax Calculator Smartasset

Vermont Sales Tax Guide And Calculator 2022 Taxjar

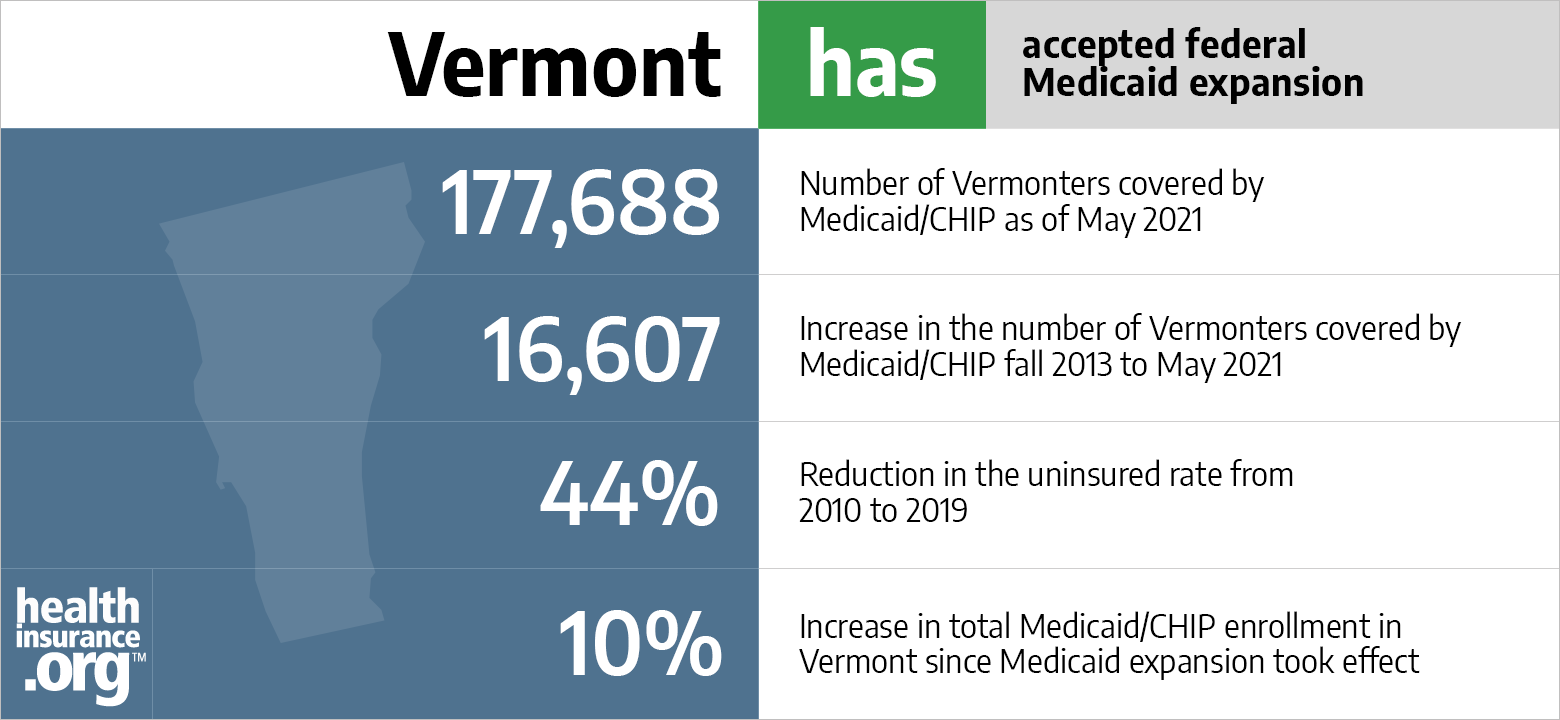

Aca Medicaid Expansion In Vermont Updated 2022 Guide Healthinsurance Org

Personal Income Tax Department Of Taxes

Mapped The Cost Of Health Insurance In Each Us State Healthinsuranceproviderscorner Travel Insurance Healthcare Costs Medical Insurance